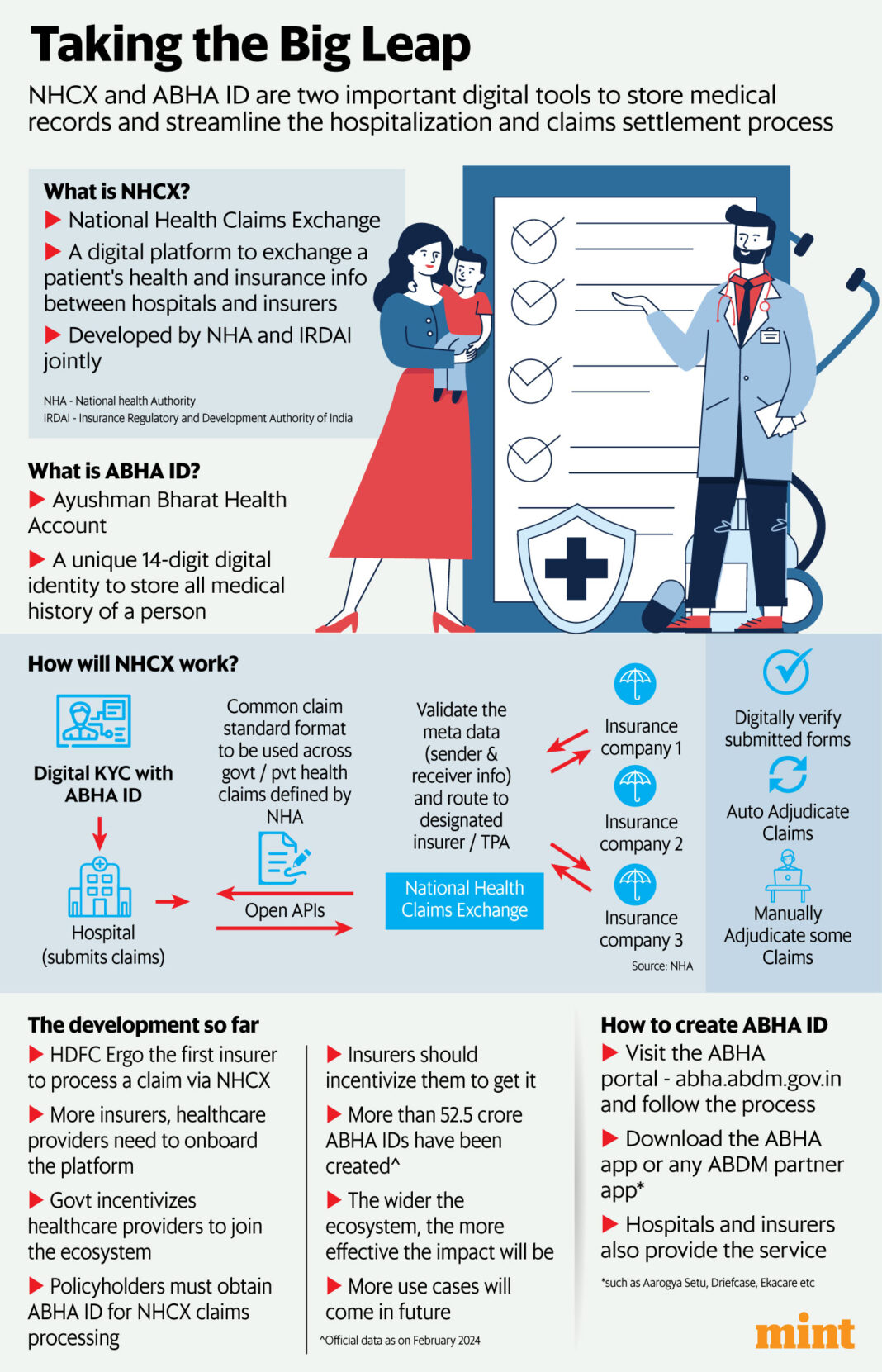

Think about a unified platform the place all hospitals, insurance coverage corporations, and stakeholders come collectively to digitize and streamline this course of. Enter the Nationwide Well being Claims Change (NHCX), an initiative developed by the Nationwide Well being Authority (NHA), the Union well being ministry, and the Insurance coverage Regulatory and Improvement Authority of India (Irdai). This digital public good guarantees sooner, clear, and environment friendly claims processing, enhancing affected person experiences whereas lowering operational prices.

What was as soon as an idea grew to become a actuality final week when insurers equivalent to Reliance Basic Insurance coverage and HDFC Ergo grew to become among the many first to course of a declare by means of NHCX. An HDFC Ergo policyholder present process a deliberate medical process at Jupiter Hospital in Thane, close to Mumbai, had their coverage particulars effortlessly fetched utilizing the ABHA ID (Ayushman Bharat Well being Account Id) after the hospital notified the insurer.

“We offered pre-authorisation approval inside 39 minutes and the discharge approval was accomplished in 49 minutes. The auto filling of the sufferers’ coverage particulars in NHCX expedited your complete course of, making certain a swift response and we efficiently processed the declare of ₹45,345,” says Parthanil Ghosh, president – Retail Enterprise, HDFC Ergo Basic Insurance coverage.

The present state of affairs versus NHCX

Presently, sufferers should current their insurance coverage playing cards to hospital workers, who manually fill out declare kinds, scan paperwork, and add them to the insurer’s platform. This guide verification course of is fraught with friction because of non-standardized and non-digital procedures.

View Full Picture

NHCX goals to revolutionize this. Every policyholder could have an ABHA ID, a digital healthcare identification akin to the Aadhaar for citizen identification. Healthcare suppliers will share affected person particulars by means of this ID, and insurers can entry it equally. NHCX, mixed with ABHA ID, acts as a communication protocol amongst payers (insurance coverage corporations), suppliers (hospitals, nursing houses), beneficiaries (policyholders), and different entities. The system is designed to be interoperable, machine-readable, auditable, and verifiable for correct and reliable data trade.

Digitizing your complete healthcare chain, nonetheless, presents vital challenges. “The success of NHCX will rely on the community of healthcare suppliers being built-in on the platform and policyholders generate their ABHA ID for storing our well being information. I want to see a heightened consciousness amongst residents and hospitals about the identical together with policyholders choosing cashless mode of claims settlement,” famous Ghosh.

The ABHA ID card

To course of claims by way of NHCX, acquiring an ABHA well being ID card is obligatory. This distinctive 14-digit digital identification quantity shops an individual’s complete medical historical past, from consultations and prescriptions to diagnostic checks. This central repository simplifies entry and monitoring of well being paperwork for sufferers, hospitals, and insurers. As of February 2024, over 525 million ABHA IDs have been created.

“ABHA ID creates a centralized repository to your medical data, simplifying the sharing course of with healthcare suppliers and insurers. Together with your medical historical past available, docs can provide extra knowledgeable therapy plans, and ABHA ID can streamline insurance coverage claims by easing medical file retrieval,” defined Narendra Bharindwal, vice chairman at Insurance coverage Brokers Affiliation of India (IBAI).

Information privateness points

To make certain, with out affected person consent, no third get together can entry their particulars. Solely certified establishments throughout the healthcare phase are approved to supply well being data, in response to Anuj Parekh, Co-founder and CEO of Bharatsure.

“Whereas on paper, a strong information privateness mechanism is in place, it stays to be seen how the difficulty of knowledge privateness evolves as it’s but to get carried out on a wider scale,” he mentioned.

Incentivizing policyholders to acquire an ABHA ID may additional streamline insurance coverage processes.

Insurance coverage corporations ought to develop use circumstances for the acquisition entrance, equivalent to providing reductions for sharing private well being data, Parekh urged.

Integration of healthcare suppliers

The problem of integrating all hospitals and nursing houses into the NHCX platform stays. Whereas some might lack the sources to affix the digital infrastructure, HDFC Ergo’s Ghosh is optimistic.

Even small nursing houses now have the expertise to combine with open APIs, he mentioned. “Why I’m saying so is as a result of out of HDFC ERGO’s Ergo’s 12,000+ community hospitals, nearly 1,700 which contributes greater than 50% of the claims are within the superior stage of getting built-in with NHCX. We have now already onboarded eight hospitals as guided by NHA and Basic Insurance coverage Council as a part of the pilot mission,” Ghosh added.

To assist this integration, the federal government has launched the Digital Well being Incentive Scheme (DHIS), encouraging healthcare establishments to affix the NHCX ecosystem. “NHA is actively working to incorporate nursing houses and hospitals within the Nationwide Well being Consent Ecosystem (NHCE) by means of incentive programmes, providing rewards to healthcare suppliers for becoming a member of the NHCE. Moreover, they’re collaborating with healthcare associations and organizations to advertise the advantages of NHCE participation,” mentioned Bharindwal of IBAI.

Affect on insurance coverage prices

Business consultants imagine that digitizing the claims course of will improve transparency and scale back operational prices. This discount needs to be mirrored in decrease insurance coverage premiums, as decreased insurance coverage fraud—a major consider premium hikes—will mitigate pointless bills.

Moreover, hospitalization prices are anticipated to lower as a result of elevated effectivity of the system. It will likely be attention-grabbing to see if insurance coverage corporations and hospitals will move on the price profit to the folks. Ghosh mentioned whereas premiums might not come down (since medical inflation will proceed to be on an uptrend) instantly however the charge of improve in premiums will certainly come down with decrease fraud charge and lowering working value.

The street forward

The NHCX initiative is simply starting, setting the stage for a digital ecosystem to deal with long-standing points in hospitalization and claims processing. The trade should prioritize integrating with the platform to fulfill Irdai’s directive of authorizing cashless hospitalization inside one hour and last discharge approval inside three hours, with a deadline of 31 July.

“The digitization efforts of the UK’s Nationwide Well being Service (NHS) and the USA’s Well being Info Change have yielded combined outcomes. It’s anticipated that this initiative will take a substantial period of time earlier than reaching its outlined targets. With steady collaboration and funding from all stakeholders, it could actually convey a win-win resolution for purchasers, hospitals, and insurers,” says Surinder Bhagat – vice chairman, Worker Advantages at Prudent Insurance coverage Brokers.

Adblock take a look at (Why?)